Condominium insurance is important to have for protecting valuables and coverage for a variety of incidents. It is typically called HO-6 insurance. This type of insurance covers personal liability and living expenses in case you are displaced due to a disaster. A type of "master" policy is usually purchased by the HOA, Homeowners Association. Areas of the exterior and interior of the building are covered by this policy. However, you may want to consider additional HO-6 coverage, because the HOA insurance is likely limited. If you have valuables or want peace of mind knowing you are fully protected, it is important to look into your insurance options.

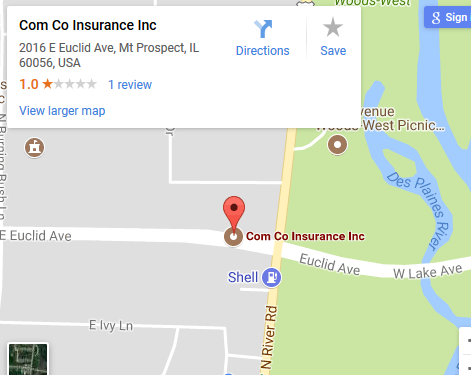

The team at Com-Co Insurance Agency Inc. of Mount Prospect, IL is happy to work with you to find a policy to cover your condominium insurance needs.

Should I Get Condo Insurance?

It depends on how much coverage you want. You will likely benefit from additional insurance as the HOA has defined limits on what kind of protection and coverage you have. Your HOA will also typically require you to have personal insurance. HO-6 condo insurance can include coverage for:

- Personal property – Electronics, furnishings, and other items are covered.

- Personal liability – coverage of legal expenses if you wind up in a lawsuit.

- Loss of use – If your unit becomes uninhabitable, this coverage will help with lodging and other expenses of being displaced.

Additional insurance and endorsements can be obtained for further protection.

Expert Insurance Agents in Mount Prospect

Contact us at Com-Co Insurance Agency Inc. of Mount Prospect, IL to speak with one of our representatives. We can help you with premium condo insurance at affordable rates. It is important to protect yourself legally, as well as securing your valuables in your condo.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions